Amazon, Peacock, and even ad-tech firms are betting big on product placement, a business that’s growing since streamers have fewer ad breaks.

In the early 1980s, the chocolatier Mars did what Elliott simply could not do—turn down E.T. The company declined to let M&Ms be the snack du jour of America’s favorite extra terrestrial. Instead, Steven Spielberg settled for Hershey’s Reese’s Pieces, and the rest is chocolate-coated history.

More than 40 years later, Mars is testing tools that might offer a shot at redemption. In what feels like something out of a science-fiction film, advertisers are using technology to digitally insert themselves into television shows after filming has wrapped to make up for lighter ad breaks on streaming services.

“All of a sudden, the 15 minutes of ads that they used to have on national television [or] cable is no longer an acceptable experience for viewers,” Andrew King, VP of product at ad-tech firm TripleLift, told Marketing Brew.

Though audiences might not notice (or ideally notice, but just enough), product placement is a $23 billion industry that’s growing. Traditionally, these deals are worked out before shooting, sometimes eight months in advance, and involve someone on set making sure the product looks just right. In exchange, the advertising revenue can help boost a production’s budget. (Just ask Wayne and Garth.)

During this month’s NewFront presentations, both Amazon and Peacock pitched tools that they say can integrate brands into shows after the fact.

Though details were sparse, Amazon’s Virtual Product Placement tool, still in beta, is being used in a slate of Amazon Originals, including the Bosch franchise and Tom Clancy’s Jack Ryan.

In a test with GroupM, M&Ms saw a 6.9% increase in brand favorability and a 14.7% increase in purchase intent, according to an Amazon spokesperson. It’s also only available for titles set in contemporary periods, and not kids’ content. So, no, Don Draper won’t be chugging a White Claw. Yet.

Peacock calls its version In-Scene Ad, but stopped short of providing much detail. Both NBCU and Amazon declined interviews with Marketing Brew, and neither answered questions about cost or shared further detail about who’s actually testing the tech.

In practice, it’s all (hopefully) subtle—you’re watching Larry David casually stroll past a poster for Doritos, only that billboard was placed there digitally. Similar technology has been used by live-sports broadcasters in recent years, where virtual banners cover NBA courts or a pitcher’s mound.

Unlike those live broadcasts, some streamers are promising product placement in 3D, like a bag of McDonald’s on a dining-room table or even an F-150 parked in the background, meaning just about any brand could be a potential client.

Subliminal advertising > advertising

TripleLift has been pitching a product-placement tool called—brace yourself—Dynamic Brand Integration since 2020, and has since placed products across Tastemade, Whistle TV, and Canela TV. On the brand side, it has worked with clients including Fat Brands and Gray Whale Gin, among other CPG, auto, and pharmaceutical clients TripleLift executives declined to name.

King declined to detail how much revenue the tool has generated, other than to say that TripleLift’s CTV business is the “fastest-growing product line within the company.” He said it currently has inventory available in 48,000+ TV episodes across different platforms.

TripleLift’s offering makes product placement biddable and done instantly, using “proprietary technology” that can contextually analyze a scene and insert a branded asset. That means that while a viewer in Arizona might see Walter White sip a can of Mountain Dew, another in Delaware might see him drink Dr. Pepper.

Michael Shields, general manager of connected TV at TripleLift, told Marketing Brew that while it has worked with clients in the “mid-market” to test the tech, it’s pitching itself to larger streamers. “We are talking to every major [streaming] service,” Shields said. “I feel very confident that many of them are going to look for a solution provider like us.”

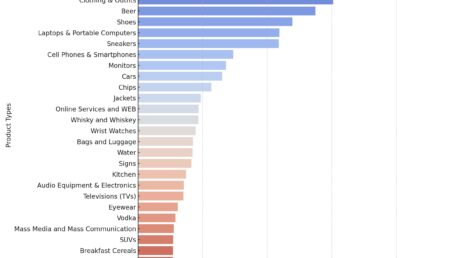

However, there are limits for product placement. “I always tell our partners like Hulu, this is probably not going to happen in The Handmaid’s Tale,” Shields said. Instead, unscripted programming, like cooking shows, make the most sense for now, at least as the industry gets comfortable with the technology.

Buy-in

Natalee Geldert, senior director of brand media and partnerships at marketing agency PMG, told us that she’d want to work directly with streamers before looking into programmatic product placement.

“If we’re going to drop a billboard or drop [a] placement, let’s not do it every single time the opportunity presents itself,” she said. She was more concerned as a viewer. “[If] I am going to sit and watch a specific show, or catch up on a specific season, am I just now going to be inundated with products?”

Carolina Portela, VP and director of strategic investment at Magna, said the agency is researching virtual product placement. But, like CTV as a whole, there are measurement concerns.

“What is the value of just having a branded soda on the table in the background? Are consumers even going to notice that? I’m not sure.” she said. “If it’s done…tastefully, and not in your face, it’s almost subliminal messaging. We’ll see how consumers respond, or if they even notice.”

Originally published on Marketing Brew, written by Ryan Barwick